The data supplied on nonemployers show a generally increasing number of these businesses from a total of 195 million in 2004 to 257 million in 2017. Youll also need to fill out a Form 8829 Expenses for Business Use of Your Home.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

If you depreciate your home with the home office deduction and profit when you sell your home you are responsible for paying capital gains tax of no more than 25 on the gains that came from the home office deduction.

/1040x-3fa72efbba54446580f8dcbf8ec947e6.jpg)

Home office deduction 2020 form. The deduction is capped at 1500 per year so the maximum space you can claim is 300 square feet. The downside is that since home office tax deductions are so easily abused the Internal Revenue Service IRS tends to. During the 4 years you lived in the home you were able to deduct 5000 in depreciation on the home office portion.

Which tax form do I use to claim my home office deduction. Business-related toll calls are 100 deductible. Based on the above Leigh-Ann does qualify for a home office deduction.

What is IRS Form 8829. You can claim depreciation on capital items such as a computer office furniture and fittings used for business purposes in your home. Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day.

Telephone costs If you run your business from home you can claim a deduction of 50 of the rental of a telephone landline if this is also your private line. Form T2200S Declaration of Conditions of Employment for Working at Home During COVID-19 is a shorter version of Form T2200 that you get your employer to complete and sign if you worked from home in 2020 due to the COVID-19 pandemic and are not using the temporary flat rate method. First list all direct expenses such as paint wallpaper and other expenses directly related to and used in the business space.

You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses. Self-employed people can deduct office expenses on Schedule C Form 1040 whether they work from home or not. The square meterage of her home office 20m2 in relation to her house 200m2 is 20200 which is 10.

The home office deduction form is Schedule C. This write-off covers office. File only with Schedule C Form 1040.

First you must determine the percentage of your total expenses that are allocated to your business. Fill in the form. Instead of keeping records of all of your expenses you can deduct 5 per square foot of your home office up to 300 square feet for a maximum deduction of 1500.

Your home business space deduction includes two parts. Your employer completes and signs this form to certify that you worked from home in 2020. The home office deduction limit depends on your gross income Form 8829 will help you figure out your limit.

These expenses may be deducted at 100. Home business owners were previously required to complete Form 8829 to calculate the home business space deduction. You can report the home office deduction on federal Form 8829 Expenses for Business Use of Your Home This form is filed along with Schedule C Profit or Loss From Your Business on your personal Form 1040.

This amount will be your claim for 2020 up to a maximum of 400 per individual. Updated for Tax Year 2020 May 4 2021 0415 AM. If you were not able to deduct depreciation on your home office or were not reimbursed by your corporation for depreciation there is no income to report and 100 of the gain up to the limits will be tax-free.

Because they have no paid employees nonemployers are more likely than others to operate their businesses from their homes and seek a home office tax deduction. As previously mentioned you must file a Schedule C on Form 1040 to be eligible for the home office deduction. Names of proprietors Your social security number.

10 X R 120 000 R 36 000 R 36 000 R 5 000 R 6 666 R 26 366. Part I Part of Your Home Used for Business. Expenses for Business Use of Your Home.

Its worth 5 for every square foot that makes up your office space. Go to wwwirsgovForm8829 for instructions and the latest information. Therefore Leigh-Anns home office deduction for the tax year.

You report business use of your home on line 30. You can exclude 295000 of the gain and will pay tax on only 5000. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes.

You have to file Form 8829 with your 1040. For anyone who wants to claim the simplified home office deduction the IRS allows you to claim a deduction thats based on the square footage of your office. Deducting these expenses will help reduce your total taxable income and save you money.

Use a separate Form 8829 for each home you used for business during the year.

/1040x-3fa72efbba54446580f8dcbf8ec947e6.jpg)

Form 1040 X Amended U S Individual Income Tax Return Definition

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

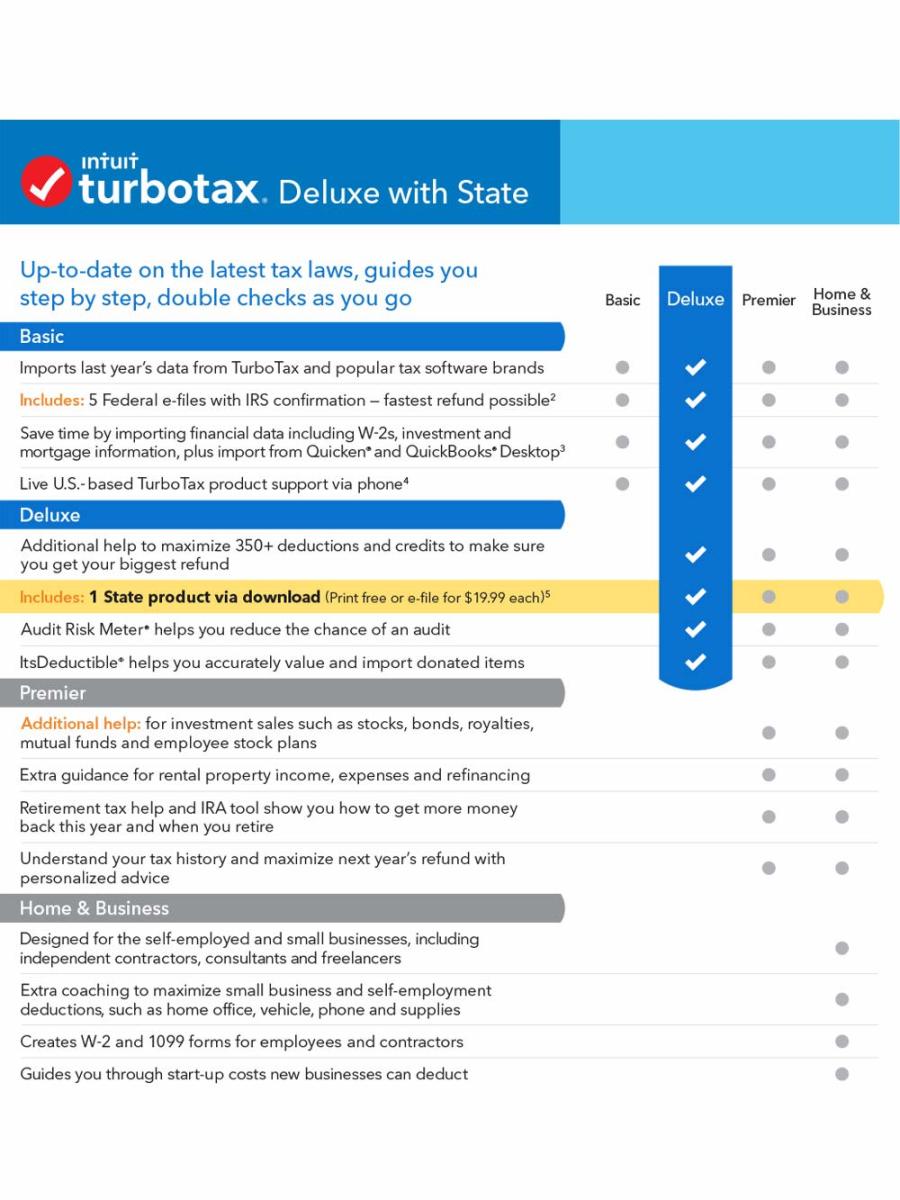

Which Version Of Turbotax Do I Need Toughnickel

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Budget Template

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Instructions For Form 2106 2020 Internal Revenue Service

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Step By Step Instructions To Fill Out Schedule C For 2020

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Tax Forms Small Business Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Step By Step Instructions To Fill Out Schedule C For 2020

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet